Increasing client primacy and deepening relationships with a redesigned financial wellness review experience.

The Financial Wellness Review is a shared screen experience in which bankers and clients jointly explore financial details resulting in personalized system-generated financial wellness and product recommendations. As the Senior Design Lead, I played a pivotal role in creating the overall strategy, bridging the executive leadership team and design team communications, obtaining leadership buy-in, and designing the experience.

OVERVIEWThe Objective

The 1.0 version of the experience was designed to gather extensive information from clients/prospects in order to provide a holistic view of their current financial situation and make the right recommendations.

The team was challenged by the head of consumer banking to evolve the 1.0 experience into a new and improved 2.0 version with the main objective of making the process easier for our bankers and clients in order to increase primacy (likelihood that clients will bank exclusively with the bank), cross-selling and ultimately deepen client relationships.

The initial target audience was the head of the consumer bank and the head of the retail bank, focusing on securing squad funding for the build and implementation of the Financial Wellness Review 2.0 experience. After leadership buy-in, the focus shifted on continuing to design, build and implement the 2.0 experience.

The Results

Securing $1M in funding for the build and development of the new experience.

A bought-in executive leadership team with a better understanding of the importance of the 5-step design thinking process.

An easy-to-read flow that rapidly builds trust and confidence between clients and bankers.

A 63% increase in product openings and credit product bookings.

17,000 new reviews were generated in less than 30 days

My Role

I was the Senior Design Lead on this project. My responsibilities and design activities included:

Establishing the design strategy and project plan

Reporting weekly progress to the executive leadership team

Planning and facilitating all design thinking workshops

Leading junior designers

Building low and high-fidelity prototypes

Planning and facilitating testing

THE PROCESSAn iterative, human-centered approach to problem-solving

Phase 1 : Discover

STAKEHOLDER ALIGNMENT WORKSHOP

Aligning with stakeholders and reframing the business purpose into a user-centric question

The first step in this project was to plan and facilitate a stakeholder alignment workshop to make sure all stakeholders were aligned and had a clear definition of success. The workshop included activities such as refining the user-centric question, defining success, and reviewing the design strategy and project plan.

What was apparent from the start of the project was that the stakeholders were very focused on meeting a business goal and not solving a specific user problem. The first thing I did was reframe the business purpose into a user-centric question.

Business Purpose

We want to increase primacy, cross-sell, and deepen client relationships by selling more products. We also want to make things easier for our bankers and clients.

User-Centric Question

How might we rapidly build trust and confidence between a client/prospect and branch banker so they can identify the right product solutions and immediate next steps to start achieving their financial goals and improve their financial wellness?

The user-centric question helped ensure that stakeholders were and remained aligned towards a common goal and that the project remained user-centric throughout.

RESEARCH

Gathering existing knowledge

I spent the next couple of weeks gathering existing knowledge and reviewing feedback from both bankers and clients through our various feedback tools. A cross-functional team had just finished conducting an FWR effectiveness case study looking into the current experience, interviewing users, and analyzing current data to provide recommendations to improve the experience.

Phase 2: Analyze

PROTO-PERSONAS

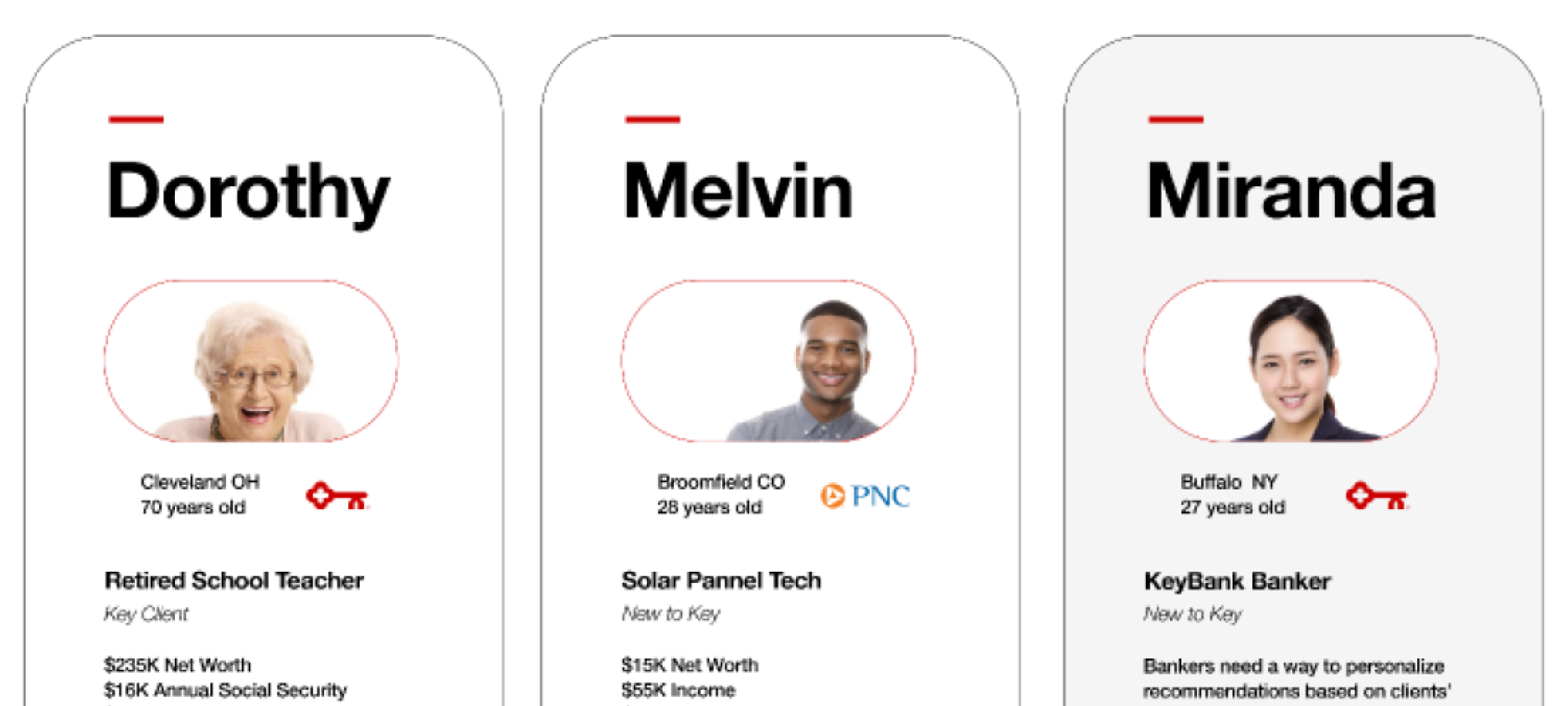

Leveraging the findings from the case study research, as well as the additional feedback collected from bankers and clients I created three proto-personas: two client personas and one banker persona.

CURRENT STATE JOURNEY MAP

Identifying current pain points to generate innovation opportunities.

These proto-personas were leveraged in a current state journey mapping workshop that I facilitated with our product team (including our Product Owner, Tech Lead, and QA Lead), two bankers, and one client that fit the proto-personas.

INSIGHTS

This exercise helped the team identify pain points and opportunities that I then synthesized into high level insights. Some of the key insights identified included:

Insight # 1

Creating value quickly is critical to success.

Clients tend to be skeptical upfront that the banker/FWR will be able to help them. Building trust and showing value early on in the process will help make the experience more successful. This challenged us to present recommendations sooner in the experience.

Insight # 2

Simplified recommendations will help both clients and bankers.

Because of the large number of recommendations sometimes presented, clients rely on bankers to help prioritize them for them, yet some bankers don’t feel like they have the information they need in order to do so. This led us to exploring how we could simplify our recommendations experience ( i.e. prioritizing, filtering, bundling)

Insight #3

Integrations will help clients and bankers trust the tool.

The more we can automate/simplify/pre-fill the experience, the more clients will trust us and the more bankers will trust the tool to help. This challenged us to explore new ways to integrate with other internal systems and incorporate that in our roadmap.

Phase 3: Ideate

IDEATION WORKSHOP

Exploring solutions to the pain points identified

Using the insights identified in the Discover and Analyze phases, I planned and facilitated an ideation workshop to start exploring solutions to the pain points identified. I made sure to include our stakeholders, members of our product team as well as some bankers and clients in the session. It’s crucial to have other team members including Devs, BAs, QAs, and product partners participate in these workshops to ensure that we are getting all perspectives up-front and ultimately creating a viable, feasible, and desirable experience.

Using a 6-1 ideation activity, the team came up with 40+ ideas to explore. The team then voted on the top ideas.

Post-workshop I took the top-voted ideas from the ideation workshop and using affinity mapping, created high-level categories to start exploring in the prototyping phase. This allowed us to identify the most important ideas generated during the workshop:

Show value/recommendations early with high-level questions (Experience)

Show value/recommendations early with big data/analytics (Capability)

Recommendation bundles (Feature)

A different way of presenting questions/answers (Feature)

Getting to Know You (Feature)

Improved follow-up/next steps (Feature)Centralized accounts screen (Feature)

Ability to customize (Feature)Integrated tools for bankers (Feature)

Phase 4: Prototype

LOW FIDELITY

Rapidly testing potential solutions

I started by creating low fidelity wireframes of 4 initial concepts and testing them with 10 bankers. Based on initial feedback from bankers and our stakeholders, we started to focus in on one concept and started working towards a higher fidelity concept.

HIGH FIDELITY

Creating an experience to demonstrate our solution and its value

I continued to partner with my product team and subject matter experts to start crafting the recommendation bundles and start looking at the logic (i.e. what do we need to know in order to generate these bundles, how do we incorporate pre-screen, prefill, etc.). Once we had a working prototype, we were ready for testing.

Because stakeholders already had a set vision and solution in mind, it became particularly challenging at this stage because the experience created as a result of the design thinking process did not match their initial vision of the experience.

A pivotal moment for this team was when I suggested creating two versions of the prototype: the version created as a result of the design thinking process and the version recreating the executive leadership’s initial vision. Additionally, instead of simply demoing them to the team, I also suggested creating a role play for the two prototypes to truly showcase both experiences.

Working closely with an experienced banker, the Product Owner and I created scenarios and scripts for both experiences. The feedback from leadership was unanimous! They all agreed that the version created as a result of the design thinking process was superior. This enabled us to move to the next stage of the design thinking process, Test.

Phase 5: Test

Our testing plan included facilitating focus groups and 1:1 interviews with bankers as well as conducting 11 in-depth interviews with both Key and non-Key consumers. Overall, the experience was well received by users but the testing helped us identify opportunities for improvements. Some of the top opportunities included:

revisiting some of the copy and question options, revisiting how we presented the benefits and features on the bundle screen, and ensuring that the experience is short but is still able to feel personalized and valuable to the client.

Questionnaire Flow and Copy

We received feedback from both clients and bankers regarding the questionnaire flow and copy. They helped us identify questions that needed modification or removal, as well as suggest changes to some of the wording to improve the overall experience. For instance, we found out that the 'reason for visit' question did not include 'CDs' as a selectable option.

Benefits and Features

Users didn’t initially pay attention to the features and benefits listed on the bundle screen but found them useful once discussed. This challenged us to revisit the UI and copy in oder to make it clear that the benefits are tied to the bundle vs. the reason for visit.

Short and Personalized

Making the experience short was a big priority for the team but it turns out that clients still expect the experience to take some time and require gathering some sensitive financial information to feel like they are getting valuable and customized recommendations. This allowed us to add additional questions up-front to provide a more personalized bundle.

The ImpactWhy was this approach important?

Advocating for and creating a user-centric experience

Because we continued to iterate on the user-centric version, we put our clients’ and bankers’ feedback first and created an experience that ultimately led to our business goals because of that.

Reaching 100% alignment with leadership and stakeholders

Although we were not aligned from the start, going through this process allowed us to all feel fully aligned and work as a team to better serve our clients and help our bankers do their jobs better.

Evangelizing the power of Design Thinking

Getting everyone on board with understanding the value of the design process can sometimes be challenging, especially with senior leaders. Making sure they are part of the process and showing them the power of Design Thinking is a great way to continue to evangelize it across organizations.

Did we meet our goals?

Yes, we secured $1M in funding for the build and development of the new experience.

We were also able to have a fully bought-in executive leadership team with a better understanding of the importance of the 5-step design thinking process.

The easy-to-read flow that rapidly builds trust and confidence between clients and bankers was iteratively built and launched the following year helping us reach the following goals:

Generated 17,000 new reviews in less than 30 days

Led to a 63% increase in product openings and credit product bookings

Received a star rating of 4.7/5 from over 1,900 users

“The design process is helping us keep our clients and teammates at the forefront of everything we do.”

Director of Retail Sales & Services